By Julia Stanistreet | Business Development Manager at NAOS Asset Management

As a rational value investor it makes sense to buy an asset at a price less than the tangible value of that asset with a view that over time the value will be realised.

Listed Investment Companies (LICs) trading at discounts to their net tangible asset values (NTA) can present a value opportunity but investors should be aware that if these discounts persist over time then this value may never be released.

A very basic illustration of a Discount and Premium to NTA;

You have $10,000 to invest in the stock market and you’ve decided to use an ASX listed investment Company (LIC) to gain exposure to a particular equities strategy.

A basket of listed stocks with an underlying market value of $10,000, these are available to you in a LIC to buy for a 10% discount i.e. you pay $9,000 for $10,000 worth of stocks.

A basket of listed stocks with an underlying market value of $10,000, these are available to you in a LIC to buy but at a 10% premium i.e. you pay $11,000 for $10,000 worth of stocks.

So what causes this disparity and what should investors look for when it comes to buying LICs at discounts to NTA?

A LIC premium to NTA can exist when there is a lot of shareholder demand for the LIC or if the company is issuing more shares at a price greater than the NTA, this can drive the LIC share price up over and above its underlying asset value. Hypothetically, if the portfolio was liquidated each shareholder would be returned less per share than the share price.

The opposite is true for LICs trading at discounts, if there is little demand for a LIC there can be downward pressure on the share price causing it to trade at a discount to its underlying asset value. In addition, if a company issues more shares in the LIC at a share price lower than the NTA this can further exaggerate the discount. In the case of a LIC trading at a discount, hypothetically, if the portfolio was liquidated each shareholder would be returned more per share than the share price.

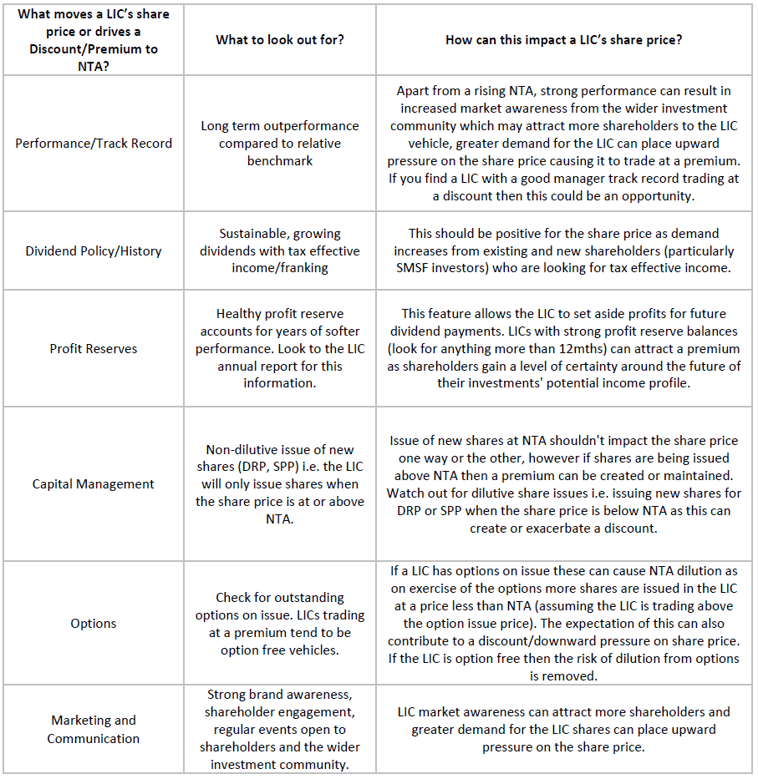

Surely the rational investor would take advantage of the discounted opportunity however not all LICs are created equal. In our view, the following is a list of the key items investors can use to gauge whether a LIC trading at a discount could move towards trading at NTA or even a premium.

It’s not an exact science but in our view a LIC trading at a discount exhibiting many positive attributes mentioned above could present an opportunity for shareholders who could benefit from unlocking value via the narrowing of the discount over time.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.

Published 1 February 2018

Join our investment community. Be the first to receive NAOS News, Insights and Invitations.