By Sebastian Evans | MD and CIO of NAOS Asset Management

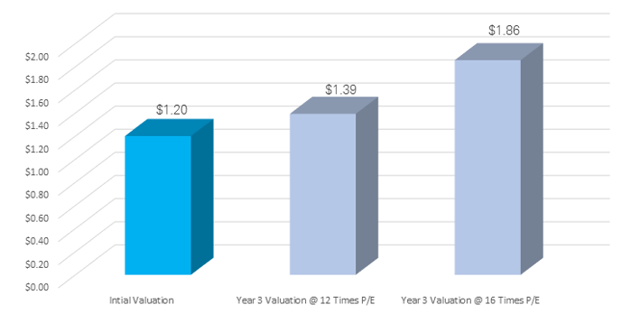

Investors often talk about the potential for companies to grow earnings and the effect this has on a company’s value over the long term. We would argue that factors which may contribute to a price earnings (P/E) multiple re-rating can be even more powerful as a valuation tool. The following scenario explains why the P/E applied is such a key variable when valuing a company.

Valuation Scenario

The key variable from the equation above is what P/E Company A should be valued at rather than what the EPS will be at the end of year three.

Based on the above, it is clear that most of the leverage in a company’s valuation is within the multiple that an investor is willing to pay for a company’s earnings stream at a point of time in the future. A company’s P/E can be dependent upon a range of subjective factors such as industry backdrop, reputation of management, consistency of earnings and industry consolidation along with many others.

A good example of this occurring within the market is a company called Service Stream (ASX: SSM). In FY2015 SSM had an EPS of $0.03 and a share price of circa $0.40. This implies a P/E of slightly over 13 times earnings. For FY2017 SSM has guided for EPS of $0.07 per share and the share price today is $1.31 which implies a P/E of almost 19 times earnings.

At a broad level, the SSM business has not changed considerably over the past three years, it has three business divisions and is mainly a contracting business with a focus on the telecommunications and utility industries. Interestingly even the revenue profile of the business has not changed dramatically, which in FY2015 was $411 million and in FY2017 is expected to be $497 million.

So what has led to the re-rating in the P/E of SSM? In our view three main factors: Firstly, the debt profile of the business has decreased significantly due to management’s focus on cash flow generation. Secondly, a new management team which has met and exceeded market expectations consistently. Finally, the industry tailwinds for demand in SSM’s services driven by the rollout of the National Broad Band Network (NBN).

Clearly investing in such a business three years ago would have presented any investor with a number of potential risks but as the results show, the risk adjusted return profile has more than compensated any investor, and as such investors are now comfortable applying a higher P/E ratio when valuing this company.

NAOS try to invest in companies with characteristics similar to those of SSM, namely an existing revenue profile, a strong balance sheet, lack of broker or wider market coverage and potentially a new management team that has been in the role for 12-24 months, as these factors often lead to a potential P/E re-rating by the wider market and resultant share price appreciation.

Disclosure: The two listed investment companies (‘LIC’s’) that Naos Asset Management manage, being the Naos Emerging Opportunities Company (ASX: NCC) and the Naos Absolute Opportunities Company Limited (ASX: NAC), both hold less than 20 stocks each and can have cash weightings of up to 100%.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.

Join our investment community. Be the first to receive NAOS News, Insights and Invitations.