By Jared Tilley | Senior Investment Analyst at NAOS Asset Management

“At some point if you’re successful, you will outlast your founders as a company. If you are going to outlast that founder, that handoff is going to be super critical” - Satya Nadella, CEO, Microsoft Corp.

The vast majority of the investment community is fascinated with Founder-led businesses and rightly so. The empirical research and evidence conducted on Founder led businesses and their outperformance versus the broader market has been well documented and justifies this fascination.

However what happens when a successful business outlasts it’s Founder/s? Is the next CEO just a ‘normal’ CEO?

I first came across the concept of ‘Refounders’ listening to Reid Hoffman, cofounder of LinkedIn, on Masters of Scale when he interviewed Satya Nadella (see link to the podcast review LINK) ). Nadella is Microsoft’s third ever CEO after Bill Gates and Steve Ballmer. On becoming the CEO, Nadella had an interesting perspective which was to “recognise first that I’m not a founder, obviously. I felt like, Oh, I just can’t be like, Okay, here’s the third guy who just shows up and does what Bill and Steve did.”

Now one could easily argue that ‘Refounder’ is just a new term to describe a CEO who is entering the business to execute a new strategy, which goes along with other terms such as ‘turnaround specialist’ or ‘pair of safe hands’. But for arguments sake, in some instances there might be more commonalities between a Refounder and Founder than first thought.

In terms of Founders, there are several attributes that investors and researchers focus on in an attempt to quantify the reasons for outperformance, some include:

Thus, can the above list of attributes be used to gauge whether a new CEO is more ‘Founder-like’ than just an ‘ordinary’ CEO?

As noted above, the delineation between Refounder and CEO, is somewhat grey and blurred at times, but we do believe we have found a Refounder in Chris Dunphy at Move Logistics, which is dual listed in Australia and New Zealand (ASX:MOV / NZX:MOV).

Dunphy was a former Executive Director of Mainfreight Ltd (NZX:MFT) and General Manager of MFT’s international division, and joined MOV’s board in July 2021 after orchestrating a substantial investment and sell down from the previous founders. Dunphy spent ten years at MFT having joined the firm in 1993 before helping take the business public in 1996 then spearheading their global growth by acquisition strategy in the late 90s.

For context, MOV is a freight transport and warehousing business established in 1869 in New Plymouth, New Zealand. The business has grown its reach and capability over its 150-year history, but over the last two decades, it has conducted close to 10 acquisitions including a reverse listing on the New Zealand Stock Exchange (NZX) in November 2017.

Unfortunately, since listing in late 2017, the stock has come under considerable pressure, declining ~50% up until Dunphy joined the Board in July 2021. For comparison the NZX has increased by 33% over the same period.

Within Founder led business, one of the most referenced metrics that investors first look at is shareholder alignment, with the key metric being shares held by management and the board. Dunphy appears to have significant shareholder alignment, holding 1.8 million ordinary shares. While this equates to ~$1.8m its worth noting that he has a call option, which was negotiated at the start of his tenure on the board, for 5 million shares, spread across three tranches, noting the options expire in July 2024.

Outside of Dunphy, Craig Evans, who is the new CEO and will be discussed later on, started on 1st February and was granted 1 million restricted stock units which will vest at the end of a three year period.

Some would argue shares held is a crude metric and while it is appropriate to also look at KPIs and other factors, if the options were to convert today, Dunphy and Evans would have approximately ~6% of total shares on issue and thus have plenty of “skin in the game”.

In the abovementioned podcast, Reid Hoffman states “I believe companies don’t just need founders… they also need Refounders. As businesses scale, Refounders keep mission and culture on track, and are responsive to a changing world”.

With this viewpoint in mind, it is worth diving into the refreshed mission and culture at MOV.

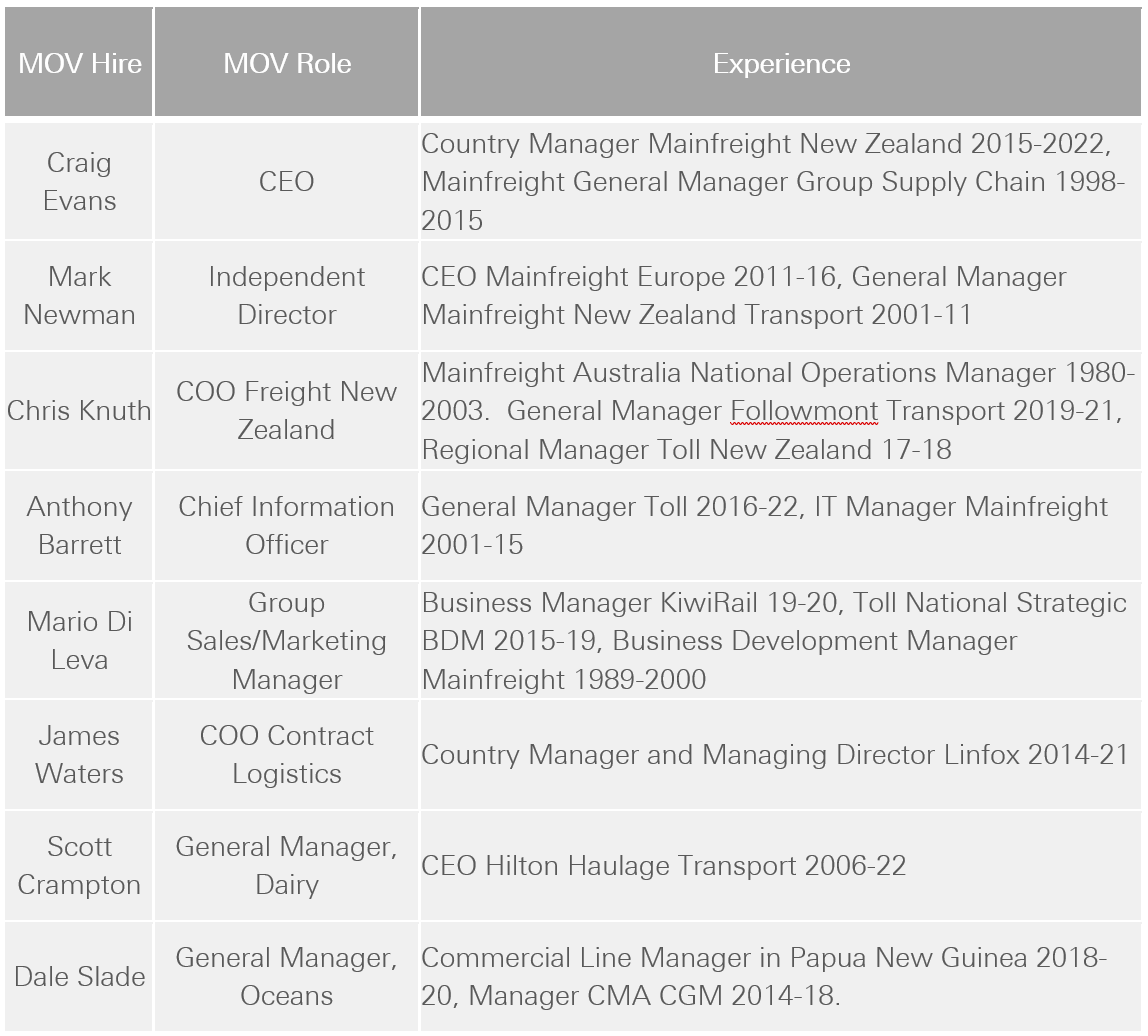

Shortly after joining the board, Dunphy stated during the FY21 earnings call, “Leadership, well that just goes without saying, in terms of a service business, which is what Move [Logistics] is, we need to have these business units run by very committed, very capable leaders.” True to his word, Dunphy has refreshed the executive team making eight new appointments.

The table below sets out the recent hires, in which it is worth highlighting a few things;

“It doesn’t make sense to hire smart people and tell them what to do. We hire smart people so they can tell us what do to” – Steve Jobs

Most of us are familiar with the concept of a CEO looking to hire people ‘smarter or better than themselves’. One could argue this is a quality of strong leadership. We would also argue that this mentality is in sync with a typical Founder when looking for a Refounder CEO to take over the reins and position a company for a new phase. In the context of MOV, on paper, this may be one of those instances.

With new people comes a new culture but part of the refresh with any organisation is a revitalised strategy and mission. Early on, there was a rebranding and name change, followed by several structural changes to improve the MOV business. Those structural changes included:

The company provided a trading update in November 2022 in which they announced a contract loss of $14m. While this is disappointing and does provide some short-term pain, we believe the executive team are acting like founders by being disciplined in focusing on margins, recognising the inability to run a successful business long term that is purely focused on volume.

Still in its infancy, MOV secured their first cargo vessel from Europe. It has the capacity to carry 350 containers or 5,000 tonnes of bulk cargo and will focus on regional ports between the trans-Tasman.

An oceans division with only one ship won’t move the dial, however the business did secure $10m of funding for a second vessel which will operate between the North and South Island. This added capacity will offer customers an alternative to trucking and supports our theory that the management team are making small incremental steps in establishing a much larger operating business.

We do believe this will make a material difference to the business by way of margin improvement as it is industry best practice and will have flow on effects to the service customers receive. However, it will take time as new trucks wait times are roughly 12-18 months.

With any turnaround story there are plenty of risks as history has shown they generally take twice as long and cost twice as much. Thus its worth sitting on the other side of the fence and flagging a few risks:

Digital infrastructure roll out – like any established business that boasts a 150 year track record, there is likely to be some dated technology and in MOV’s case it’s their digital infrastructure. The roll out is progressing and despite the fact the end result will provide a large number of efficiencies, not only improving the customer experience but also margin improvement, like any IT deployment it takes significant time and resources to implement.

Now some might not agree that there is a difference between a founder and a refounder and whether Dunphy classifies as the former, but it’s hard not to be impressed with the experienced management team that he has installed. Furthermore, it is clear that the strategic decisions he has made to date are focused on the long term, even at the detriment of short-term earnings.

At NAOS, our investment approach seeks companies whose mindset is directed towards the long term. We are attracted to management teams that are patient and think in years not quarters. Whether this be a Founder or Refounder, we focus on shareholder alignment and management’s ability to allocate capital in the most efficient way that will drive successful long-term outcomes. Like any investment, there are risks that have to be carefully assessed, and while the road ahead might be bumpy at times, we firmly believe that MOV ticks a lot of boxes.

Original Article Published on Livewire 28 March 2023) - Click Here

Join our investment community. Be the first to receive NAOS News, Insights and Invitations.