Glenn Freeman (featuring Robert Miller)

As governments around the world continue to pump the bellows, with record stimulus payments a near-universal feature of economies everywhere, the rotation from Growth to Value has been quite extreme across some markets and sectors.

In global markets, the key “cyclical” financials and energy sectors gained 32% and 51% between the end of October and February. And Australian banks stocks have risen 39%, energy by 34% and materials by 17% from the depths of last March's pandemic nadir.

However, over the same period, the poster-child sector of the growth universe, technology, was up just 14% and 16% for the NASDAQ 100 and global IT sector, respectively, according to Morningstar research.

Traditionally, a value stock is one that trades at a lower price than the company’s performance may indicate is reasonable. This gauge of what is reasonable, or not, is based on several fundamentals including earnings, dividends, book value or some other metric. Value stocks typically have high dividend yields and low price-to-book and price-to-earnings ratios (though not always).

On the other hand, growth stocks are those considered to have the potential to outperform either the overall market or a specific part of it for a period of time. These stocks often don’t pay dividends, with most excess cash they generate typically reinvested to keep the businesses growing.

That said, some fundies refuse these polar definitions, as you'll see below. In the following article, the first in a three-part series, I’ve asked portfolio managers from four funds to outline the main steps they following in selecting stocks. They also explain how this process might vary when considering either growth or value names.

The contributors are:

Daniel Moore, co-portfolio manager, Investors Mutual

There are some nuances in terms of how we look at more industrial businesses compared to resources, for example, but apart from that, the basic attributes are largely the same across both growth and value.

Firstly, we look for companies that have strong competitive advantages, and we really want to make sure this is sustainable. The company needs to invest in its business to make sure it maintains this advantage, and ideally to grow its competitive moat over time.

We look at earnings, and prefer those companies with a more recurring style of earnings stream, with strong cash flows to help fund the reinvestments needed for ongoing growth opportunities and dividends. Strong recurring cash flows are a must.

We then want a strong management team and board. This is very important: we have seen poor management teams over time destroy a lot of value. We’re really looking for an honest and experienced team with relevant expertise and who are well-aligned with the end investor. Preferably, they will have a large shareholding in the company and appropriate long term incentive plans focused on returns and shareholder value. And obviously, we want to own businesses that grow their earnings over time.

The final factor that is very important is that we want to buy these companies at reasonable prices. This doesn’t necessarily mean a low PE (price-to-earnings multiple), but a low price relative to the quality of the business. We are happy to pay an above-average market multiple if it is an above-average business.

Paying a reasonable price relative to quality is paramount. “Reasonable” here means I look at the quality of the business relative to the other opportunity sets out there and measure the price relative to the returns a business can earn. We also consider the company’s history:

Stephen Bruce, Perennial Value Management

We start with the track record of the company, as a key indicator of the sustainability of a business.

And we put a lot of emphasis on cash flow and balance sheet because dividends are a really important part of our value-oriented process. Because capital growth is good, but when you look over time, a surprisingly big proportion of total returns in the market actually comes from dividends and franking credits.

Of course, we also look for things like good management teams, but also seek to avoid value traps. To see what type of returns are being generated within the company’s industry, a key question is whether the company is in an industry where they’re simply not making their cost of capital.

We also look to avoid things with looming structural threats, such as the media sector in recent years, which has been very tough – or where there’s a threat in terms of the company’s ability to adapt to meet that challenge.

We stay away from really “deep value” stocks, those companies that are simply hoping for something positive to happen in their industry or sector to lift them. Often that does occur, but we don’t want to be relying on something like that for the business to generate a decent return. So we really avoid those “blue-sky” dependant companies.

Robert Miller, NAOS Asset Management

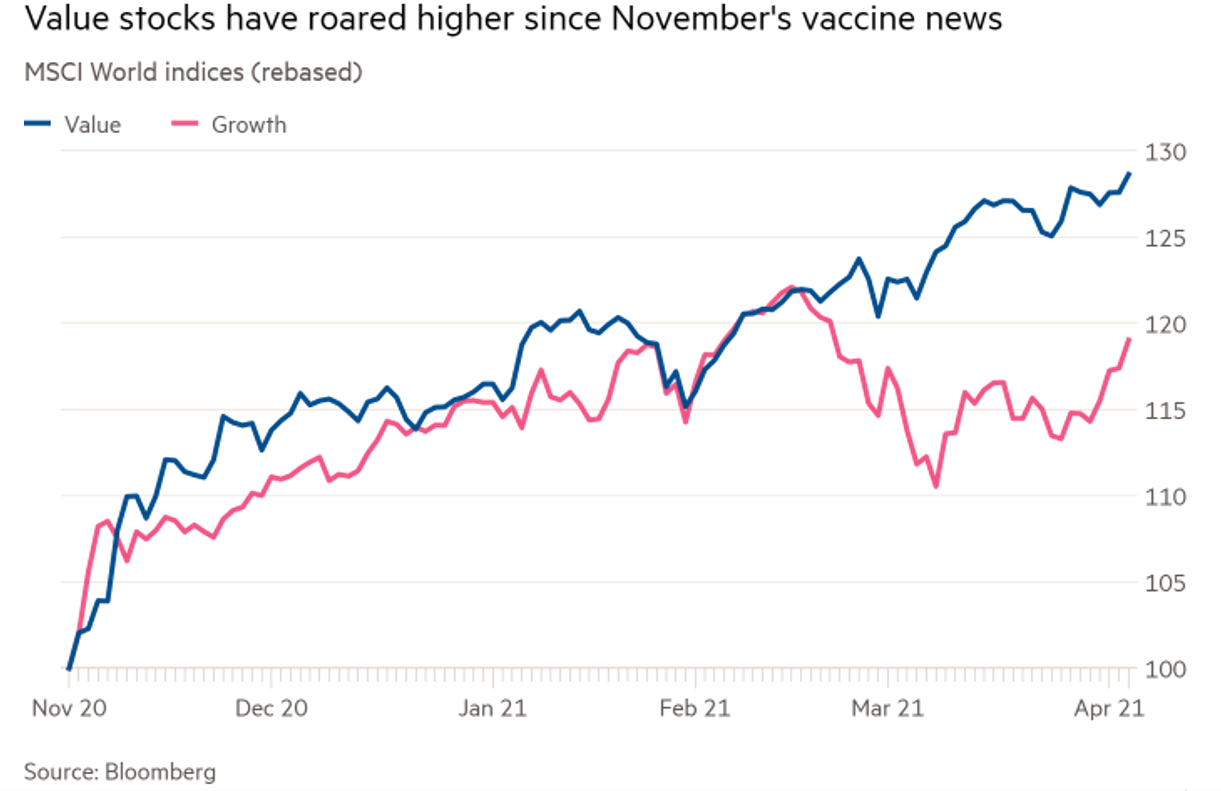

In our view, the typical definition of value investing stems from the Benjamin Graham philosophy of “cigar-butt investing”. We recognise there is a general view of segregation between value and growth, and the value category has made a comeback of late. The below chart highlights this.

But at NAOS, we don't view segregation in value and growth sectors in such a way. We assess an idea on its individual merits. Our investment beliefs don’t change in accordance with the type of company we’re looking at.

A key component of our investment philosophy is identifying businesses that are likely to grow their earnings over time, but where the price implied is not a fair assessment of the current value of the business. Additionally, the value of the business should increase over time if earnings grow. We are happy to take a long-term view on that future worth.

Other investment beliefs we combine with the above include:

In our view, business worth is not simply a quantitative measure of price versus value. Business worth is holistic and includes numerous other elements such as:

Using all of the above, an assessment of an undervalued business doesn’t simply mean identifying “cigar-butts” but an undervalued definition can have a much wider application.

Michael Goldberg, Collins St Asset Management

The main steps we follow involve aggressive filtering of the investment universe. You can’t eat relative returns. To find those ASX-listed companies with the highest chance of producing superior real returns, our process focuses on finding stocks with:

As an investor, when you find a company you like, the first step is to determine what it’s worth. You should then discount your “intrinsic value” back by a further 40%. We all get it wrong sometimes, so it’s best to factor that into your buying price upfront.

You must also understand if the company you want to invest in is cheap with good reason, or if the market is truly missing something. This means rolling up your sleeves and getting your hands dirty, because great ideas aren’t found (or at least validated) from behind a computer screen.

Our actions here include meetings with numerous parts of the company and its market, including:

Our investment process is consistent across all stocks. Like most investors, we are just trying to buy something we value at $1 for 50 cents, and we want to make sure that any company in which we place our investors’ money is strong enough to thrive under any market conditions.

More united than divided in their stock selection processes, the most important takeaways for end-investors are clear to see. Obviously, company fundamentals are paramount, but the price you pay is also central in deciding which stocks make it into your portfolio's value sleeve. Some stand-out points from the above responses include Miller and his team's rejection of the value-growth dichotomy; Bruce's emphasis on dividends and franking, and Goldberg's 40% discounting method.

Livewire: Published 23 April 2021

Important Information: This material has been prepared by NAOS Asset Management Limited (ABN 23 107 624 126, AFSL 273529 and is provided for general information purposes only and must not be construed as investment advice. It does not take into account the investment objectives, financial situation or needs of any particular investor. Before making an investment decision, investors should consider obtaining professional investment advice that is tailored to their specific circumstances.

Join our investment community. Be the first to receive NAOS News, Insights and Invitations.