Angus Kennedy (featuring Robert Miller)

2020 delivered immense uncertainty for economies and capital markets however unprecedented levels of fiscal stimulus coupled with record low-interest rates continue to push stock prices to record highs.

This pick-up in investment coincided with an October – November bounce back in IPO volume after an understandably sluggish period brought on by Covid-19. With recent global names in AirBnB and DoorDash launching, the realm of primary offerings is an intriguing space for investors.

In the first part of this collection, we reached out to three experts to reflect on the IPO landscape through 2020, and assess the impact of Covid-19. Further, each fundie nominated a notable raising from the year and the factors that made them unique.

Responses from:

IPO confidence perhaps a warning

Robert Miller, NAOS Asset Management

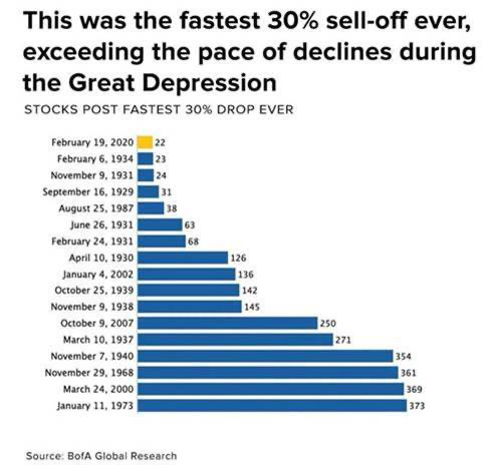

Thinking back to March when equity markets were at the peak of pessimism, nobody could possibly have imagined we would end up having a very buoyant IPO market in 2H2020. Remember this was the fastest 30% sell-off in history.

It feels like a long time ago where we were seeing all the COVID-discounted balance sheet raisings that happened in 1H2020, with approximately $25bn raised in three months. COVID has clearly had a very significant impact on equity capital markets in 2020.

Ideally, IPOs are typically undertaken in a period of investor optimism. What we have seen in 2020 is the IPO window has been well and truly ‘open for business’ in the latter part of the year. For this to occur so soon after we experienced a period of heavily discounted balance sheet raisings is quite something.

We are big believers that the IPO quality can be a good barometer for the health of the bull market period. Equally, when the IPO window closes it usually slams shut very quickly. As a general rule of thumb, the longer the IPO window remains open, the more likely that valuations ascribed to IPO companies will increase and the quality of IPO companies will likely get worse. For incoming shareholders that is a dangerous combination.

We believe there are starting to be examples that point to such factors occurring. We have seen valuations justified by as ‘relatively cheap; vs ‘expensive’ peers. We have seen IPOs occur that could be viewed as having short-term COVID related benefits and opportunistically capitalising whilst they can.

That is not to say whether such companies are good or bad companies, rather, simply that the more IPOs we see, the more cautious we become. We believe this is a prudent approach to lower our risk of permanent capital loss over the long term.

#1 outstanding IPO:

Of the 40+ ASX IPOs which have occurred since July 1st, the median share return to date has been approximately 28%. Most of these companies are not within our investment universe, nor our circle of competence so we do not look at them.

We are not offshore investors but the IPO of Airbnb was something we were particularly interested to follow. Why? Because if one of the most COVID-impacted of all companies can have a stunningly strong IPO, then this is a pretty telling sign about the sense of euphoric investor appetite we are seeing in equity markets.

Airbnb (ABNB) is a great concept that has completely changed the way we travel. We are big believers in the domestic ‘travel boom’ that we hope takes off in Australia in 2021. Despite our convictions, it is quite amazing that Airbnb:

Again, we are not here to say whether Airbnb is a good or a bad investment, rather providing an insight into the optimistic nature of equity markets and their willingness to focus on some macroeconomic factors and not others.

IPOs highlight preferred investor themes

Martin Pretty, Equitable Investors

In March - April of this year, it looked like a dangerous year for smaller companies requiring capital to further their ambitions - but it has turned out to be the year of opportunity for companies and investors. Pre-COVID in the Australian market we had a smattering of IPOs with mixed results.

The panic selling of March temporarily closed the window on new listings and things remained very quiet while discounted capital raisings from leaders swamped the market, consuming investor capital and the bandwidth of brokers and corporate advisers.

The healthy rebound in markets brought with it renewed investor confidence and there appeared to be no shortage of capital flowing into deals as the year progressed - so brokers began to dust off IPO files with the first real influx listing in August with great success. Things snowballed from there through to December.

COVID-19 clearly had an impact on the type of company that excited investors. Cloud-based, online subscription, online retail and health technology were all in demand. We saw little in the way of Real Estate Investment Trusts (REITs) or old-world industrial businesses.

Being exposed to the right themes appeared to be more important at times than the underlying fundamentals of the businesses.

#1 outstanding IPO:

From a returns perspective, it has to be the "reverse take over" of consumer financial services app maker Douugh (DOU). It priced its public offer at $0.03 a share in August and has since rallied to a peak just above $0.40 in November before pulling back to 17.5c - which on a fully diluted basis equates to a market capitalisation of just under $150m. That's quite incredible for a company that reported zero cash receipts in the September quarter. Clearly, investors are expecting big things. We didn't have the good fortune to have participated in this listing.

Covid-19 the key for online business

Dean Fergie, Cyan Asset Management

If you’d asked me prior to this year unfolding, I would have said the economic and sentimental backdrop for IPOs this year was likely to be quite poor. I think most market participants have underestimated the huge demand for equities since the market lows in March. As we all know, demand is met by supply hence the substantial amount of both IPOs and secondary market raisings we’ve seen, particularly in the second half of this year.

Was Covid significant? - Yes certainly for the online-centric business that have listed (Booktopia, MyDeal, Youfoodz, Zebit, Adore Beauty, HiPages, Laybuy), many of these would not have gotten close to the valuations they’ve enjoyed or indeed not come to the market at all.

#1 outstanding IPO:

For me, the most notable IPO was Adore Beauty (ABY). Both in terms of its high profile and the investment hype surrounding the float which manifested itself in what I saw as a top-of-the-market valuation (the company was not profitable and was being floated at a value at over $600m - an EV/Sales of 6x!).

Any consumer-facing business tends to have a high profile and this rags to riches story really captured the attention of a broad public audience, many of whom may not have been experienced investors. I feel the ordinary aftermarket performance of the company (the stock presently trades more than 20% its IPO price) has been a real Come-to-Jesus moment for investors.

Conclusion:

A sluggish start brought on by the pandemic meant few could have foreseen the resurgent end to the year for IPOs. Upon reflection, our experts unanimously agreed that it can be easy to get swept up in the hype and important to look beyond the type of company and simply consider each on their merits. While many of the top performers came from the flurry of tech listings, there remain many operational hurdles they will have to pass post-Covid in order to prove the quality of their business.

Join our investment community. Be the first to receive NAOS News, Insights and Invitations.