The Truck Parts Industry

At NAOS we include ‘hands on’ research as part of our Investment Process. Our job means we are fortunate enough to participate in site visits to various companies and stakeholders across a wide array of sectors and industries. From time to time, we will look to share a snapshot into some of the industry insights we learn from our travels on the road.

The trucking industry

A truck & trailer parts supplier

Western Sydney

February 2022

Supply chain issues

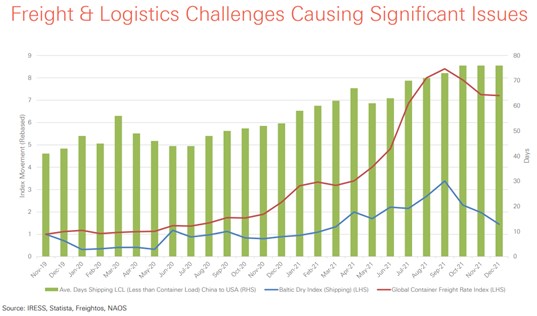

Over the last twelve months, there has been a trend within the trucking industry (similar to many other industries) to increase inventory levels as timing for ordering and delivery has been pushed out. We’ve all heard of the freight & logistics issues globally, which are yet to substantially improve. The below chart highlights these challenges.

Ageing truck fleet

According to the Australia Bureau of Statistics (ABS) the average age of heavy-rigid trucks in Australia is 16 years, higher than it was at the 2016 census. For context, trucks in many European nations have an average age closer to 10 years.

With the current global supply chain issues, there are long wait times on new trucks, with some customers having to wait until 2024 for delivery of trucks they’ve ordered. New trucks aren’t replenishing older trucks at the same rate.

As the average age of trucks increases this has ramifications around road safety & emission levels. According to a study by the peak road agency roads, trucks under 5 years old have a lower crash rate and lower emission levels than older vehicles. Older trucks also have a greater reliance on replacement parts & maintenance requirements.

The impact of e-commerce

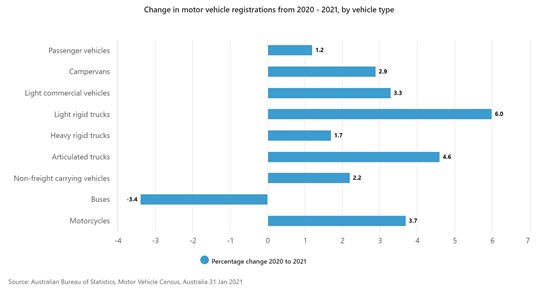

The flow on effects of the paradigm shift in retail has created obvious demand for industrial & logistics property assets but what is perhaps less understood is how this has impacted the trucking industry. Light commercial trucks & vehicles are perfectly suited to be the facilitator of ‘last mile delivery’. The ABS 2021 census shows that the growth rate in registrations of this category of vehicles is ~ 5x that of passenger vehicles. The Japanese truck brands dominate this space, including Isuzu, Hino and Fuso (Mitsubishi).

Parts/supplies complexity

There is a significant level of complexity the industry faces through the sheer number of parts required to keep trucks moving on our roads. Our understanding is there can be up to ~30,000 individual parts that go into building a truck, including approximately ~2,000 parts in a standard combustion engine. Not only do parts vary by different make & model but also by year. Which of those parts is required when a truck has a breakdown…?

Whilst many of the parts are made by the original manufacturer, there can be many more aftermarket suppliers of certain parts. This complexity continues to compound over time as an increasingly ageing fleet occurs alongside growth in new truck registrations from a wider variety of truck manufacturers.

Parts/supplies requirements

Time is money when it comes to trucking fleets. A truck off the road is lost revenue, therefore maintenance and parts replacement is a critical ‘cog in the wheel’. Service, availability, functionality, and ease of installation are often much more important factors than just the price of a replacement part. Customers are happy to pay a premium for getting their trucks back on the road and are increasingly desiring ‘out of the box’ pre-assembled replacement parts to further improve their efficiencies.

Market Participants

There are three major players in this sector being Supply Networks (ASX: SNL) (Trading Name - Multispares), Bapcor (ASX: BAP) (Truckline) and MaxiParts (ASX: MXI). All three of which are ASX listed companies, however in aggregate only account for ~30% market share. Our understanding is that these major players each have their own specialisations, therefore customer crossover can be commonplace. This doesn’t seem surprising to us given the level of complexity mentioned earlier. A decent level of industry consolidation has occurred and we expect the major national players to continue getting bigger in time.

Electric Trucks

According to the Electric Trucks Report by the Australian Trucking Association (ATA) & Electric Vehicle Council (ETV), heavy vehicles make up about 4% of the road vehicle fleet but account for 8% of kilometres travelled and 23% of all road transport fuel consumed. Whilst there is a clear need for electric trucks given the disproportionate impact trucks have on the road, going electric for the trucking industry is something which will continue to lag the passenger vehicle industry for quite some time.

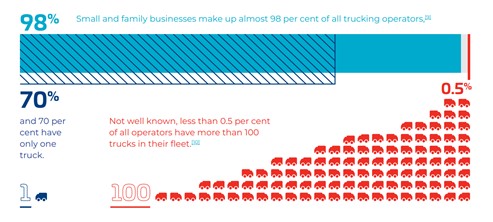

As it stands today, policy settings are not conducive and operating feasibility is a challenge. The Electric Trucks Report states that 70% of truck businesses are operating only 1 truck. The fragmented nature of the industry means a coordinated adoption of electric trucks is unlikely to happen.

Adding to this is the sheer growth in parcel volumes across Australia which mean electric trucks are likely to be additions to fleets, rather than replacements in the short to medium term.

Different truck makes & models can have very different requirements for replacement parts & supplies. Electric trucks bring another level of complexity as they will need a wider variety of parts, supplies & maintenance schedules.

When change does occur, light commercial vehicles are likely to lead the charge towards electrification. The ATA/ETV estimates that road freight tasks in capital cities and urban centres accounts for ~30-40% of total road freight, so this would have a significant impact upon emission reductions.

The key learnings from our time on the road indicates to us that there appears to be a genuine and ever-increasing importance for specialist parts suppliers to the trucking industry. Perhaps even more so than there is to the automotive industry given the negative economic consequences of trucking downtime at both an individual and national level. Parts suppliers do not appear to be a necessary evil, rather a value-added component of this industry, especially when considering the growing reliance on trucks in the years ahead.

ABS Data 2021: https://www.abs.gov.au/statistics/industry/tourism-and-transport/motor-vehicle-census-australia/31-jan-2021#average-age

ATA / EVC Study: https://electricvehiclecouncil.com.au/wp-content/uploads/2022/01/ATA-EVC-Electric-trucks_Keeping-shelves-stocked-in-a-net-zero-world-2.pdf

Important Information: This material has been prepared by NAOS Asset Management Limited (ABN 23 107 624 126, AFSL 273529 and is provided for general information purposes only and must not be construed as investment advice. It does not take into account the investment objectives, financial situation or needs of any particular investor. Before making an investment decision, investors should consider obtaining professional investment advice that is tailored to their specific circumstances. This material may include data, research and other information from third party sources. NAOS makes no guarantee that such information is accurate, complete or timely and does not provide any warranties regarding results obtained from its use. Statements contained in this material that are not historical facts are based on current expectations, estimates, projections, opinions and beliefs of NAOS. Such statements involve known and unknown risks, uncertainties and other factors, and undue reliance should not be placed thereon.

Join our investment community. Be the first to receive NAOS News, Insights and Invitations.