By Robert Miller | Portfolio Manager at NAOS Asset Management

Saunders International Limited (ASX: SND) is a small-cap industrial business which has two key operating divisions. One division focuses on the design and construction of liquid storage tanks, and the other division on infrastructure (bridges, road and rail) engineering, refurbishment and construction.

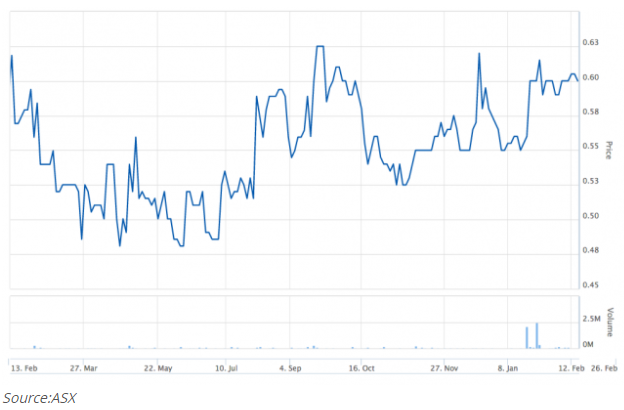

It is a relatively new stock in one of our portfolios. We’ve held it for approximately 9 months.

Saunders has a strong net cash balance sheet and has a history of paying healthy dividends. The business has been in operation for over 60 years, which gives us confidence that it provides a proven service throughout the cycle and that there is low likelihood of disruption.

The industry tailwinds through the current infrastructure cycle should drive the business for the medium to long term as there is a large backlog of bridge, road and rail construction/maintenance projects and the demand for storage tanks is increasing.

Saunders’ operations are relatively niche. There are only a few players in the storage tanks business and long-term relationships with large multinational clients are key to winning new contracts. A recent example of Saunders capitalising on their reputation in the market is the expansion of operations into Papua New Guinea as a result of existing client relationships.

On the infrastructure side, Saunders has a strategically located casting operation north of Sydney, which provides a good platform for meeting the requirements of the infrastructure projects in the greater Sydney area.

Firstly, the board, founders and management are substantial shareholders which provides excellent shareholder alignment. Secondly, the current managing director Mark Benson has come into the business in the past two years, with the objective of growing Saunders in a sustainable manner. An example of this is the acquisition Saunders completed of its infrastructure operations business in FY17, allowing it to diversify its earning base and generate synergies.

The business remains conservatively managed with management being incentivised on total shareholder return (TSR) and earnings per share growth (EPSG) remuneration targets.

Saunders’ current margin profile is significantly below historical levels. We believe the margins should continue to improve from depressed levels. We are comfortable it meets our internal hurdle return rate of 20%p.a. growth over a 3-year period.

Either around our valuation price or if there was a significant deviation from our initial investment thesis.

It was a small positive contributor to the portfolio. Saunders recently completed a placement and rights issue which we used as an opportunity to increase our position.

We see value in numerous areas:

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.

Read more Professional's Pick: Enero Group Ltd (ASX: EGG) by Robert Miller

Join our investment community. Be the first to receive NAOS News, Insights and Invitations.