Among this week’s likes and dislikes are an insurance company, a food franchise and an engineering group.

Portfolio Manager Ben Rundle of NAOS Asset Management says he likes Elders (ELD), an agribusiness company that provides livestock and farm supplies to Australia and New Zealand.

While the stock has been sold off recently on the back of lower cattle prices, Rundle believes it’ll be short lived.

“The stock is cheap relative to its peers as well as the wider market. We believe as investors become more comfortable with the new look of Elders, the share price will re-rate.”

“Elders will report their full year earnings result on the 13th November 2017 – we are anticipating not only a strong underlying result, but also an announcement that the company may start to pay dividends again post a successful turnaround,” says Rundle.

Rundle says he doesn’t like Retail Food Group (RFG), owner of food franchises such as Donut King, Michelle’s Patisserie and Gloria Jeans Coffee.

“Most of the franchises they own are quite mature and low growth, however the earnings paid to RFG head office from these businesses have been increasing which we feel is unsustainable.”

“The stock has been sold off quite a lot over the last 12 months, but despite the perceived value we think it looks more like a value trap,” says Rundle.

Michael Wayne of Medallion Financial thinks Janus Henderson Group PLC (JHG) is a buy this week.

He says the most recent result delivered funds under management, fund flows and investment returns “beyond market expectations.”

“The recent merger brings together two asset management businesses (Janus and Henderson) with enviable reputations and track records. The merger also enables the new entity to cut costs. It has cut $57 million so far,” says Wayne.

Insurance company IAG Limited (IAG) is a ‘sell’ according to Wayne, following results that missed expectations.

“It was recently trading on 17 times one year forward earnings, a premium that’s hard to justify for a mature business with declining margins and minimal room for growth across its consumer and business divisions,” says Wayne.

Brambles (BXB) has featured on Michael McCarthy of CMC markets’ good list this week. “The US business rebounded in the most recent quarter, and the European operations continue to surprise on the upside.”

“Adding appeal is the fact a weakening AUD would boost earnings and the share price closer to $9 is more attractive,” says McCarthy.

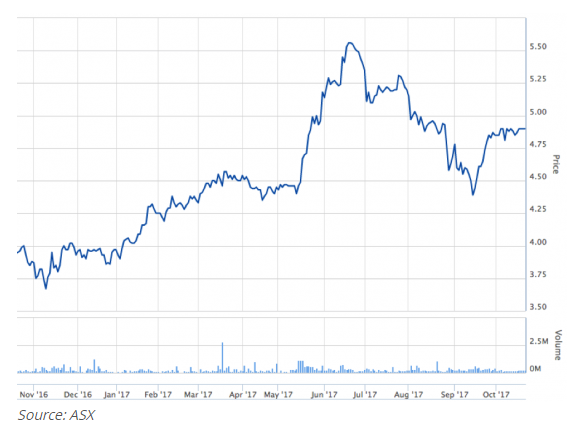

He doesn’t like construction engineering company, Monadelphous (MND). “The industry recovery at more stable oil prices is a plus, but the share price has run from $6 to $16 since early 2016,” says McCarthy.

“In my view, MND is expensive and worth shareholders’ while to take advantage of current strength (by selling).”

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.

Join our investment community. Be the first to receive NAOS News, Insights and Invitations.