“Please note particularly that we own stocks based upon our expectations about their long-term business performance and not because we view them as vehicles for timely market moves. That point is crucial: Charlie and I are not stock-pickers; we are business-pickers”

The Berkshire Hathaway 2021 Annual Report to Shareholders was released in the early hours (Sydney) of Sunday the 27th February, providing a genuinely interesting read. Buffett noted that there was little “new or interesting” at BRK over the year, yet did provide some insights into where the business stands today.

Remarkably, Buffett revealed in his letter:

• Berkshires valuable insurance float has grown from $19 million (1967) to $147 billion today

• Cash….BRK holds $144 billion of Cash (and Cash Equivalents) on its balance sheet.

• Infrastructure

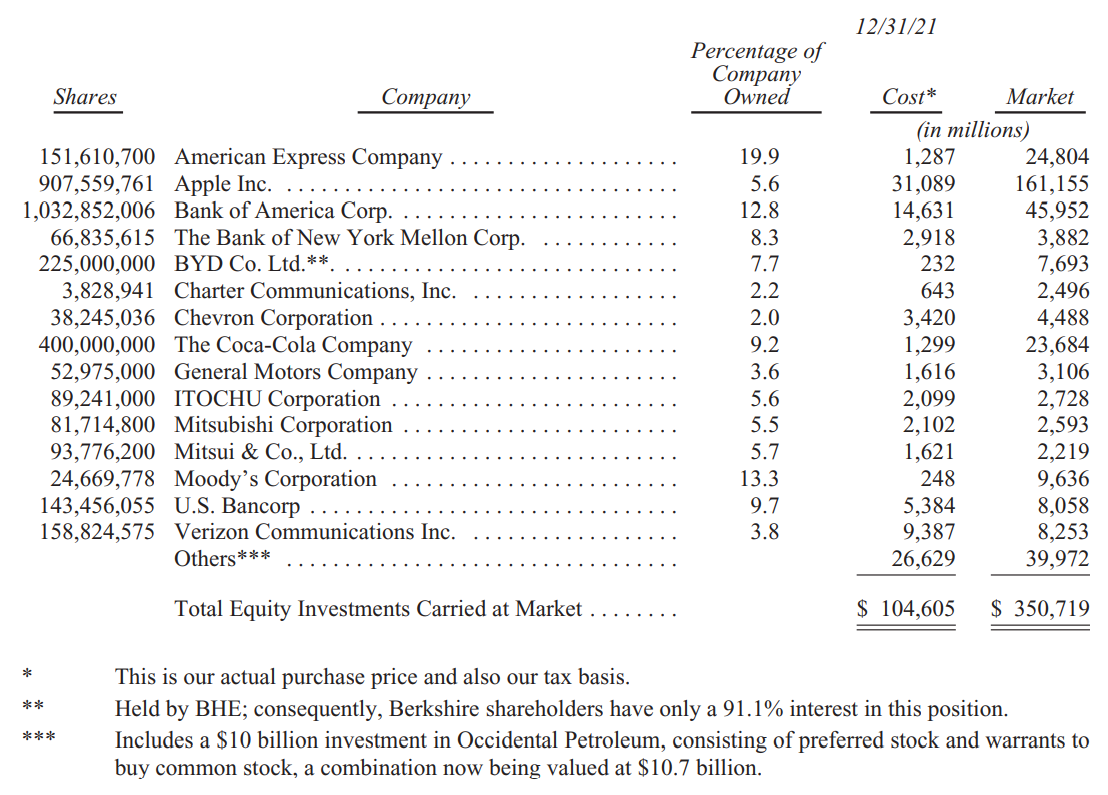

Finally, the listed Portfolio breakdown is interesting, particularly as its highlights BRKs move into Japanese trading houses and the large appreciation of Chinese EV manufacturer BYD Co. Ironically, BRK has faced criticism in the past for neglecting technology investments in favour of ‘old-world’ industries (Banks, Consumer Staples etc), yet the extreme concentration in Apple Inc (not on cost but on appreciation), directly disputes this.

Join our investment community. Be the first to receive NAOS News, Insights and Invitations.