• FY18 Profit After Tax $4.7 million

• Final FY18 Dividend Declared, 3.0 cents per share fully franked

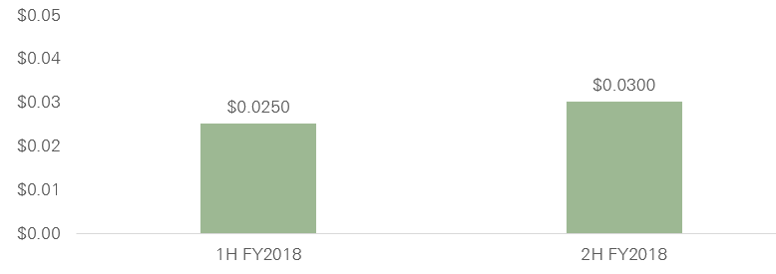

• FY18 Full Year Dividend Declared 5.50 cents per share fully franked

Thursday, 23 August 2018: NAOS Small Cap Opportunities Company Limited (ASX: NSC) today announced its full-year result for the financial year to 30 June 2018, reporting an after tax profit of $4.7 million, which sees an increase in profit from the after-tax loss of $13.9 million recorded in FY17. NSC also declared a fully franked dividend of 3.0 cents per share, bringing the full-year dividend to 5.50 cents per share. Independent Chairman, Trevor Carroll commented:

‘Pleasingly this is the first full year period that dividends have been fully franked since the 2011 financial year, and this represents the Company’s renewed focus on protecting investor capital whilst providing a stream of sustainable fully franked dividends and long-term capital growth.’

During the year, shareholders appointed NAOS Asset Management Limited (NAOS) as the Company’s new investment manager. NAOS has positioned the investment portfolio to provide shareholders with concentrated exposure to high quality undervalued industrial small-cap companies with a long-term value focus. Core to NSC’s investment process and setting the Company apart from many of its peers is the concentrated portfolio structure.

The nature of running a concentrated portfolio results in investment holdings and portfolio returns that differ to that of the benchmark or index holdings. Therefore, it is not unusual for a concentrated portfolio to go through periods of significant underperformance as well as significant outperformance to that of the wider market. NAOS Chief Investment Officer and Managing Director, Sebastian Evans stated:

‘We are very satisfied with the quality of the portfolio we have been able to form since being appointed as Investment Manager. In our view, we have in the portfolio a select group of industrial small cap businesses that are undervalued on a long-term investment horizon.’

During the year, the Board announced a change to increase the frequency of dividend payments from bi-annually to quarterly for FY19 and beyond. The first quarterly dividend for FY19 brings forward income for shareholders and creates an opportunity for shareholders to receive a more frequent income stream.

| Ex Dividend Date | 3 September 2018 |

| Record Date | 4 September 2018 |

| Last Date for DRP Election | 5 September 2018 |

| Payment Date | 19 September 2018 |

The Dividend Reinvestment Plan (DRP) allows shareholders to elect to receive their dividends in shares rather than cash. DRP shares will be acquired “on market” when the post-tax net tangible assets (NTA) is greater than the share price as at record date, thereby avoiding any potential dilution to the Company’s NTA and also assisting with closing the share price discount to NTA. Further information on how to participate in the Company’s DRP can be found at www.naos.com.au.

Important Information: This material has been prepared by NAOS Asset Management Limited (ABN 23 107 624 126, AFSL 273529) (NAOS) as investment manager of the listed investment company referred to herein (Company). This material is provided for general information purposes only and must not be construed as investment advice. It does not take into account the investment objectives, financial situation or needs of any particular investor. Before making an investment decision, investors should consider obtaining professional investment advice that is tailored to their specific circumstances. Past performance is not necessarily indicative of future results and neither NAOS nor the Company guarantees the future performance of the Company, the amount or timing of any return from the Company, or that the investment objectives of the Company will be achieved. To the maximum extent permitted by law, NAOS and the Company disclaims all liability to any person relying on the information contained herein in relation to any loss or damage (including consequential loss or damage), however caused, which may be suffered directly or indirectly in respect of such information. This material must not be reproduced or disclosed, in whole or in part, without the prior written consent of NAOS.

Published: 23 August 2018

Join our investment community. Be the first to receive NAOS News, Insights and Invitations.