• FY18 Profit After Tax $3.9 million

• Final FY18 Dividend Declared, 2.50 cents per share fully franked

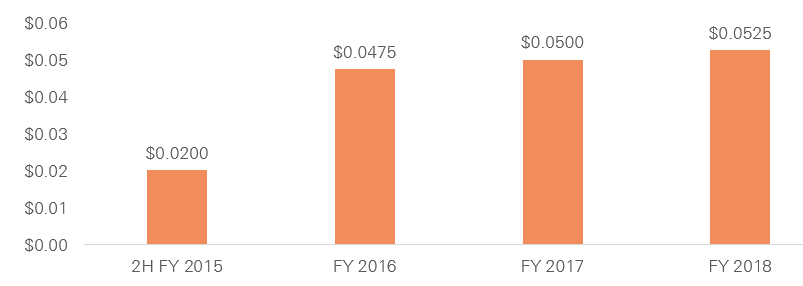

• FY18 Full Year Dividend Declared 5.25 cents per share fully franked

• FY18 Investment Portfolio Performance +10.25%

Thursday, 23 August 2018: NAOS Ex-50 Opportunities Company (ASX: NAC) today announced its full-year result for the financial year to 30 June 2018, reporting an after tax profit of $3.9 million. NAC also declared a fully franked dividend of 2.50 cents per share, bringing the full-year dividend to a record 5.25 cents per share, an increase of 5% on the prior comparative period and the fourth consecutive year of dividend growth.

The investment strategy of the Company aims to provide shareholders with concentrated exposure to high quality, undervalued midcap companies with an industrial bias, outside of the ASX 50. NAC enters FY19 with a promising group of core investment positions, whilst maintaining flexibility within the portfolio to add or remove investments if volatility in share prices eventuates. NAOS Chief Investment Officer and Managing Director Sebastian Evans stated:

‘Demonstrating the Company’s ability to protect capital, the investment portfolio is yet to recognise a negative financial or calendar year return. Protecting shareholder capital and providing long-term sustainable returns remains our core focus.’

The Board also announced a change to the frequency of dividend payments; moving from bi-annually to quarterly. Independent Chairman, David Rickards commented:

‘The first quarterly dividend for FY19 brings forward income for shareholders and creates an opportunity for shareholders to receive a more frequent income stream.’

Following FY18 year end, shareholders approved a change to the name of the Company from NAOS Absolute Opportunities Company Limited to NAOS Ex-50 Opportunities Company Limited and to a change in the benchmark index to the S&P/ASX 300 Industrials Accumulation Index (XKIAI), which the Board considers better reflects the Company’s strategic focus and competency in investing in industrial stocks outside of the ASX 50.

| Ex Dividend Date | 3 September 2018 |

| Record Date | 4 September 2018 |

| Last Date for DRP Election | 5 September 2018 |

| Payment Date | 19 September 2018 |

Under the Company’s Dividend Reinvestment Plan (DRP) rules, where shares are trading at a discount to the post-tax net tangible assets (NTA), the Company will purchase shares “on market” for DRP purposes, as opposed to issuing new shares. This means that potential dilution to the Company’s NTA is avoided. Further information on how to participate in the Company’s DRP can be found at www.naos.com.au.

Important Information: This material has been prepared by NAOS Asset Management Limited (ABN 23 107 624 126, AFSL 273529) (NAOS) as investment manager of the listed investment company referred to herein (Company). This material is provided for general information purposes only and must not be construed as investment advice. It does not take into account the investment objectives, financial situation or needs of any particular investor. Before making an investment decision, investors should consider obtaining professional investment advice that is tailored to their specific circumstances. Past performance is not necessarily indicative of future results and neither NAOS nor the Company guarantees the future performance of the Company, the amount or timing of any return from the Company, or that the investment objectives of the Company will be achieved. To the maximum extent permitted by law, NAOS and the Company disclaims all liability to any person relying on the information contained herein in relation to any loss or damage (including consequential loss or damage), however caused, which may be suffered directly or indirectly in respect of such information. This material must not be reproduced or disclosed, in whole or in part, without the prior written consent of NAOS.

Published: 23 August 2018

Join our investment community. Be the first to receive NAOS News, Insights and Invitations.