The Australian Olive Oil Industry

At NAOS we include ‘hands on’ research as part of our Investment Process. Our job means we are fortunate enough to participate in site visits to various companies and stakeholders across a wide array of sectors and industries. From time to time, we will look to share a snapshot into some of the industry insights we learn from our travels on the road.The Australian Olive Oil Industry

An olive oil farming & processing operation

Northern Victoria

May 2022

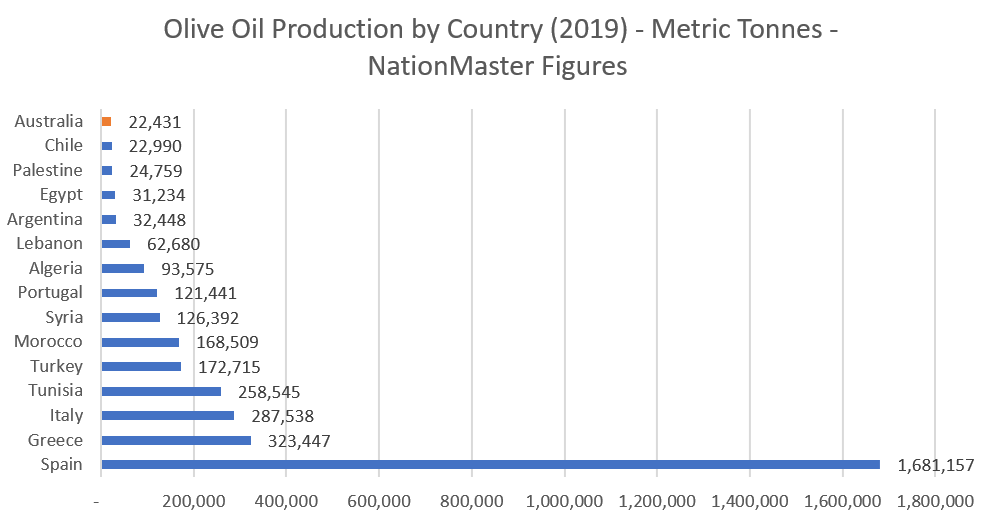

Facts & Figures

Farming Processes

Olive oil production is understood to date back to B.C. times; therefore, it is not a surprise to learn that traditional farming techniques are extremely manual. In addition, it is a very fragmented industry from a global perspective with the majority of operations ‘mum & dad’ type farming operations. Whilst there are some major olive oil brands, they are typically sourcing olive oil from this extensive group of small farmers.

In Australia the opposite is true. It is a relatively young industry that is very consolidated (approximately 90% of production is accounted for by the largest 1% of growers). We understand these vertically integrated farming operations to be far more automated than what is seen in other parts of the world.

The time taken from olive harvest to olive pressing is a major factor when it comes to the quality of the oil produced. Put simply, the shorter this duration the better. At the site we visited in Northern Victoria, on average this process takes approximately 4 hours and process automation has been a big focus of investment. The below pictures of a large-scale automated harvesting machine and bulk transporting demonstrates this.

Compare that to say Spain whereby there are over 400,000 olive growers (according to the Spanish Olive Oil Interprofessional) producing an average of ~4 tonnes each. At such a relatively small per grower scale, the capital cost for automation is not as feasible.

The result is that whilst Australia is a very small market, Australia is seen as a global leader in the olive oil industry, both from a standards/classification point of view and from a production point of view.

Olive Oil Fraud

A significant issue within the industry is the fraudulent grading and classification of olive oil. In 2013, a report published by the European Parliament stated that olive oil is Europe's most adulterated, tampered with, and counterfeited agricultural product. Despite crackdowns, in 2020 a report by the American Botanical Council found that this continues to be a rampant problem.

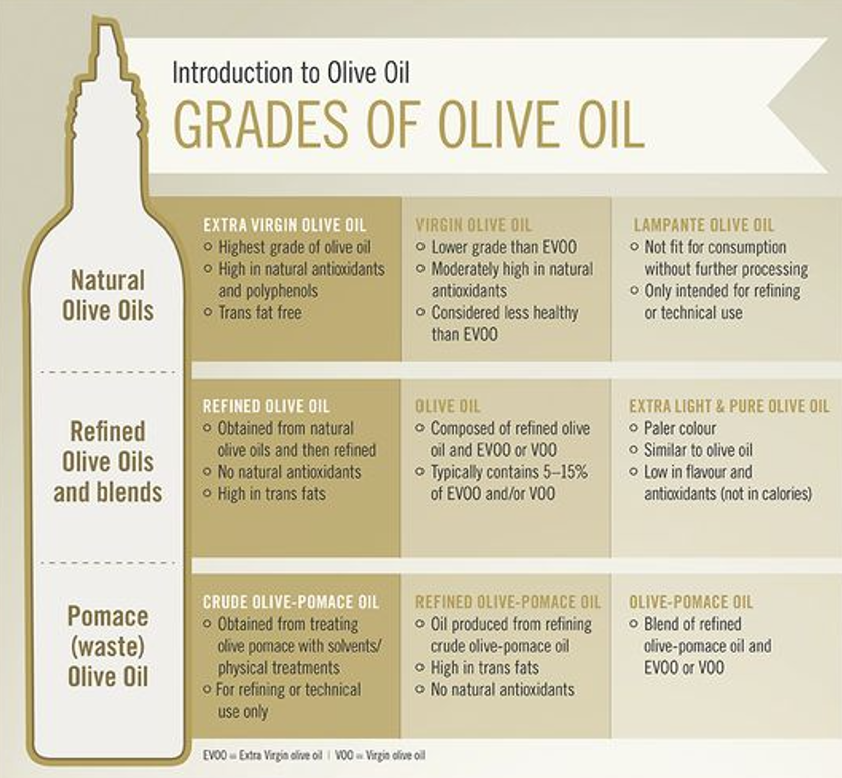

To understand how this can occur, it is important to first understand the definitions of the different gradings of olive oil. These gradings are largely classified based on production method and health characteristics. From the highest classification to the lowest is:

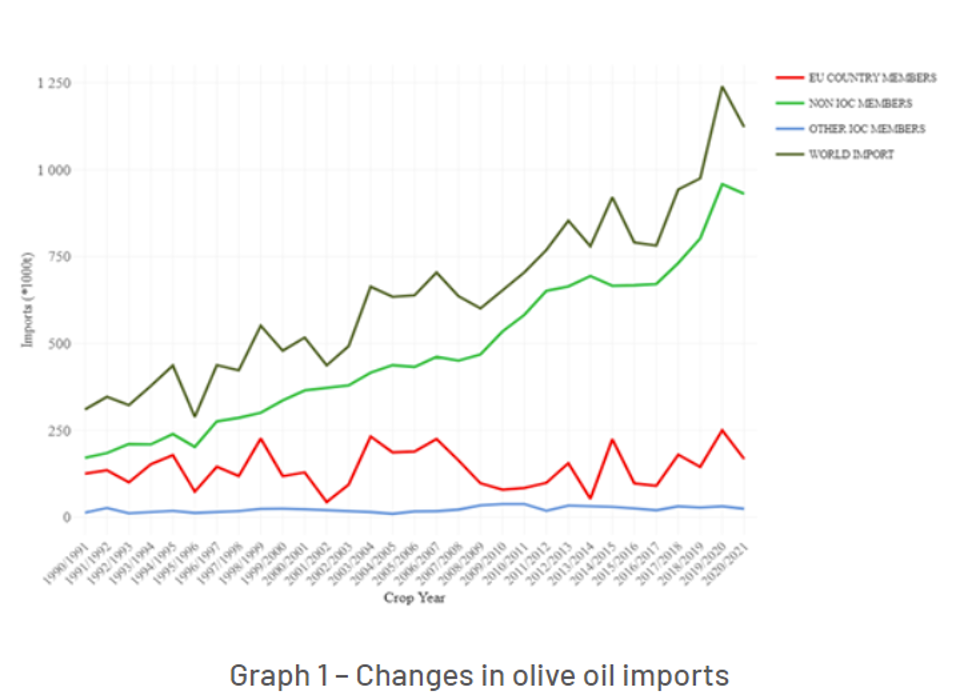

What is labelled ‘extra virgin olive oil’ may not necessarily be true to label. A low level of supply & significant demand growth (particularly for extra virgin olive oil) are two contributing factors to this problem. The below chart from the International Olive Council on olive oil imports highlights this significant demand growth.

Australia has not been immune to these fraud issues either. A 2016 study by the Australian Olive Association found that 85% of the oils tested failed to meet the Australian Standard, while 78% failed to meet the International Olive Council Standard.

Pleasingly, these standards have now changed in Australia for both imported and locally produced oils. Nowadays, the current Australian standards go above & beyond the standards set by the International Olive Council.

Whilst imported oils are frequently tested by the Australian Olive Council, given how widespread this issue has been globally, industry fraud may still be occurring to some degree.

Diet & Demand

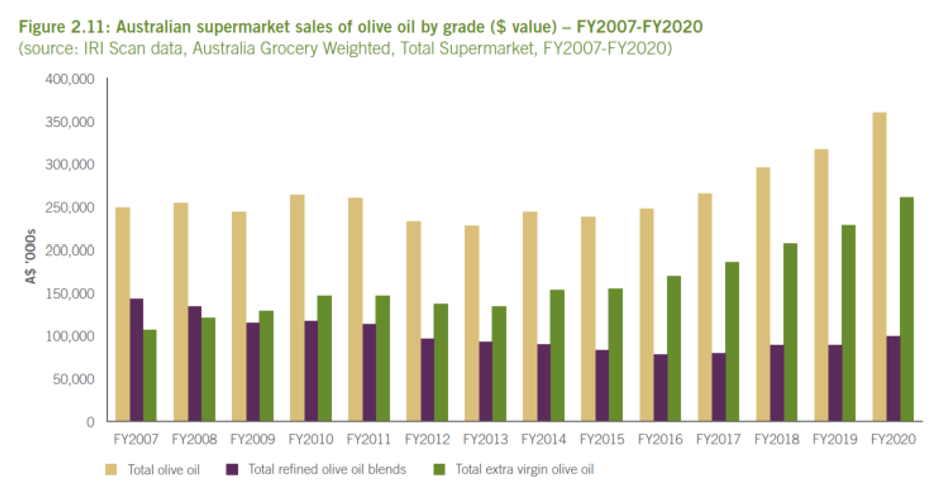

The proven health benefits of extra virgin olive oil as a staple part of the ‘Mediterranean diet’ is constantly gaining traction with Australian consumers. Not only are consumers continuing to switch to olive oil from other oil varieties, but they are also increasing consumption of extra virgin olive oil per capita. The below chart highlights this demand within Australian supermarkets.

The Australian olive oil industry is very much a nascent one vs global peers, but it is ‘batting well above its average’.

With Australian made extra virgin olive oil now accounting for a larger part of total consumption than their imported counterparts, we would expect that over time, as this demand continues to increase, in conjunction with our very limited domestic supply, prices will continue to rise.

Whilst prices may rise, we believe extra virgin olive oil is quickly becoming a ‘pantry staple’ to many, therefore if prices continue their trajectory, it may prove to be a relatively inelastic demand profile.

In summary, the long-term industry tailwinds appear to be highly robust for the Australian extra virgin olive oil industry, especially if the globally recognised fraudulent activities are further cracked down upon in time.

READ MORE

On the Road with NAOS | The Truck Parts Industry

Important Information: This material has been prepared by NAOS Asset Management Limited (ABN 23 107 624 126, AFSL 273529 and is provided for general information purposes only and must not be construed as investment advice. It does not take into account the investment objectives, financial situation or needs of any particular investor. Before making an investment decision, investors should consider obtaining professional investment advice that is tailored to their specific circumstances. This material may include data, research and other information from third party sources. NAOS makes no guarantee that such information is accurate, complete or timely and does not provide any warranties regarding results obtained from its use. Statements contained in this material that are not historical facts are based on current expectations, estimates, projections, opinions and beliefs of NAOS. Such statements involve known and unknown risks, uncertainties and other factors, and undue reliance should not be placed thereon.

Join our investment community. Be the first to receive NAOS News, Insights and Invitations.